Innholdet på denne siden er markedsføring

Navigating Change: A SKAGEN New Year Conference Perspective

As the UK begins its complicated extrication from the EU and America apprehensively welcomes a new President, it was perhaps unsurprising that the principal theme running through our New Year conference last week was uncertainty.

Looking through the current political haze, our speakers sought to make sense of the economic and social consequences of a changing world order while highlighting key trends for investors.

A rudderless world

Ex-Deputy Secretary-General of the United Nations, Lord Malloch-Brown, used a short-term and a longer-term lens to identify the biggest threats on the investment horizon. Short-term, he expects further political turmoil in Europe and the risk of "several" populist governments gaining power from elections in France, Germany, Italy and the Netherlands. "There are likely to be one or two seismic things happening which could be deeply unsettling to markets until they are better understood", the former British Cabinet and Foreign Office minister explained, while also flagging China, where President Xi's power is set to be strengthened by becoming a 'core' leader, and Turkey, which will hold a referendum on establishing a presidential governmental system, as potential risk areas.

Medium-term, he predicts turbulence as Asia pivots away from the US towards China while a re-balancing of NATO funding will see Europe having to dramatically increase its military spending at the same time as US 'soft power' diminishes. Emerging markets are likely to be challenged by American investment becoming more domestically focused and higher US interest rates.

Longer-term, Malloch-Brown expects a more transactional approach to international affairs as the global community and its institutions' capability to address problems is seriously impaired in a "rudderless world". Private sector solutions will also be increasingly needed as challenges such as population growth and climate change will exceed the reach of government.

Demographic pressures

A perspective on demographic uncertainty was provided by Professor Sarah Harper, who outlined the key population trends likely to impact consumption and resource allocation. Addressing Lord Malloch-Brown's population growth concerns, she explained why fears of a 'population explosion' are exaggerated as improving female education levels have driven down fertility rates and the global population is likely to peak at a sustainable ten billion by the end of the century.

The Founder and Director of The Oxford Institute of Population Ageing instead highlighted greater challenges from changing population density and distribution. The number of people living in urban centres is set to grow from 50% at present to 90% by the end of the century and Asia will represent an increasing proportion of the global population and labour force at the expense of Europe.

Another structural change is increasing longevity as developed world life expectancy grows by 2.5 years per decade. Half the European population will be aged over fifty within ten years. This will necessitate a transfer of resources from younger to older adults and have important consequences for healthcare spending. Professor Harper also discussed how people will have to retire later, particularly if curbs on immigration further reduce the ratio of workers to pensioners.

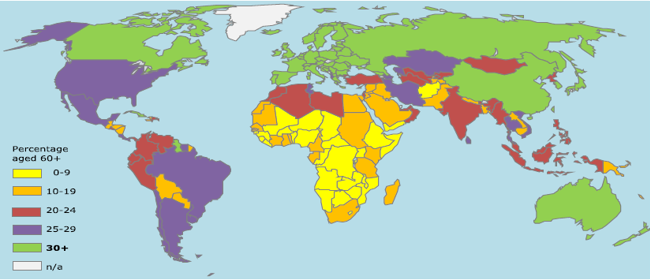

Ageing population: % over 60 in 2050

Paradigm shift

Lord Malloch Brown's belief that investors increasingly need to consider political factors was echoed by BCA Research's Chief Strategist, Marko Papic, who went further by outlining five major paradigm shifts taking place which advocate the integration of geopolitical analysis into asset allocation.

First, he believes that as America's influence weakens and global power becomes more fragmented, international conflict will increase. For investors, the growth of 'multipolarity' will boost demand for safe haven assets and defensive equities. Second, the resultant collapse in globalisation will hurt multinationals and exporters but benefit SMEs and consumer-focused sectors while boosting inflation and commodities.

Third, Papic sees societies increasingly governed by charismatic authority rather than traditional legal order as the importance of democracy dwindles. The investment implication is an increase in unexpected events due to the less predictable behaviour of enigmatic leaders. Fourth, greater state influence over investment in the US and UK will benefit domestically-orientated companies and small-caps while a more laissez-faire approach in Europe and supply-side reforms should boost European equities. Fifth, the growth of social media at the expense of traditional media will require investors to perform much greater analysis and due diligence to understand political and geopolitical risk.

Core-periphery disease

Risk was also a central theme of Dr. Jerome Booth's presentation as he discussed how global financial markets remain in a critical state as a result of excessive leverage and distortionary monetary policy. He believes that traditional financial models are flawed as they incorrectly assume that market behaviour is normally distributed, which hasn't been the case for some time: "Risk is commonly misperceived as measurable, precise and additive. It is different for each of us, even to the same investment, as our liabilities, reaction times and institutional constraints all differ."

The author of Emerging Markets in an Upside Down World explained how we are suffering from a 'core-periphery disease' where core developed markets are seen as affecting peripheral emerging ones but the impact of emerging markets on developed is ignored. Highlighting China's 50% saving ratio and reduced emerging market debt more generally, he believes the periphery is actually more stable than the core, particularly given the current problems facing the UK, US and Europe, and investors should view emerging markets as a way to reduce risk, suggesting that a 50% portfolio allocation could be appropriate.

Dr. Booth believes that unless we address the imbalance within the financial system by re-engaging with macroeconomics, history and politics, a repeat of the 2008 financial crisis is inevitable. He also advocates a return to first principles and traditional investing, based on detailed analysis and understanding, to restore balance to capital markets.

Contrarian path

This approach was echoed by Filip Weintraub, Portfolio Manager of SKAGEN Focus, who suggested that while "investment results can't be controlled", a strong investment process is the key to maximising returns. Weintraub also explained how taking a 'contrarian path' often produces the best risk-adjusted rewards, particularly if it leads to ideas that have been ignored by the market. He highlighted Greece, where equities trade at a 30% discount to European stocks, and Brazil, where the currency has depreciated by 50%, as overlooked places where the fund has been able to find attractively undervalued investments.

With such political and economic uncertainty, finding attractive returns is challenging for investors, particularly with world stock markets at their current elevated levels and interest rates remaining low. Against this backdrop, investors are likely to be rewarded for long-term thinking, particularly as volatility often creates opportunity. An investment approach which selects strong but misunderstood companies at attractive valuations to create a diversified portfolio before selling them as the market catches up, should ensure that superior long-run returns will follow.

Tackling Trump

As he begins life in the Oval Office, Lord Malloch-Brown believes that not even Donald Trump himself knows where the balance of his presidency will ultimately settle. He expects Trump to reach agreement with Congress on a domestic agenda which will include reduced taxation, fiscal stimulus, financial services deregulation and the repealing of environmental regulation.

Internationally, he expects many of Trump's aggressive pre-election promises to fall away given the tendency of overseas policies to continue across administrations. Lord Malloch-Brown did, however, flag Trump's rapprochement with Russia and hostility towards China – particularly given the growing Nuclear capability of North Korea – as well as the UK seeking to "curry favour" with the new US President to the detriment of our other international relationships, as potential risk areas.